View Poll Results: Which DTH is the best according to your experience?

- Voters

- 3. You may not vote on this poll

-

TataSky

-

Dish TV

-

SUN Direct

-

SUN Direct HD

-

Reliance BIG TV

-

Airtel Digital TV

-

Videocon D2H

-

DD Direct+

-

10-10-2024, 06:37 PM

#1021

Why Airtel wants a bigger slice of the DTH pie?

Bharti Airtel’s reported interest in acquiring Tatas’ 70% stake in direct-to-home operator Tata Play comes amid a broader consolidation within the media and digital services market in India. With Reliance and Disney coming together in a joint venture valued at $8.5 billion in India, the fight for access to premium homes is expected to grow, media experts tracking the market said.

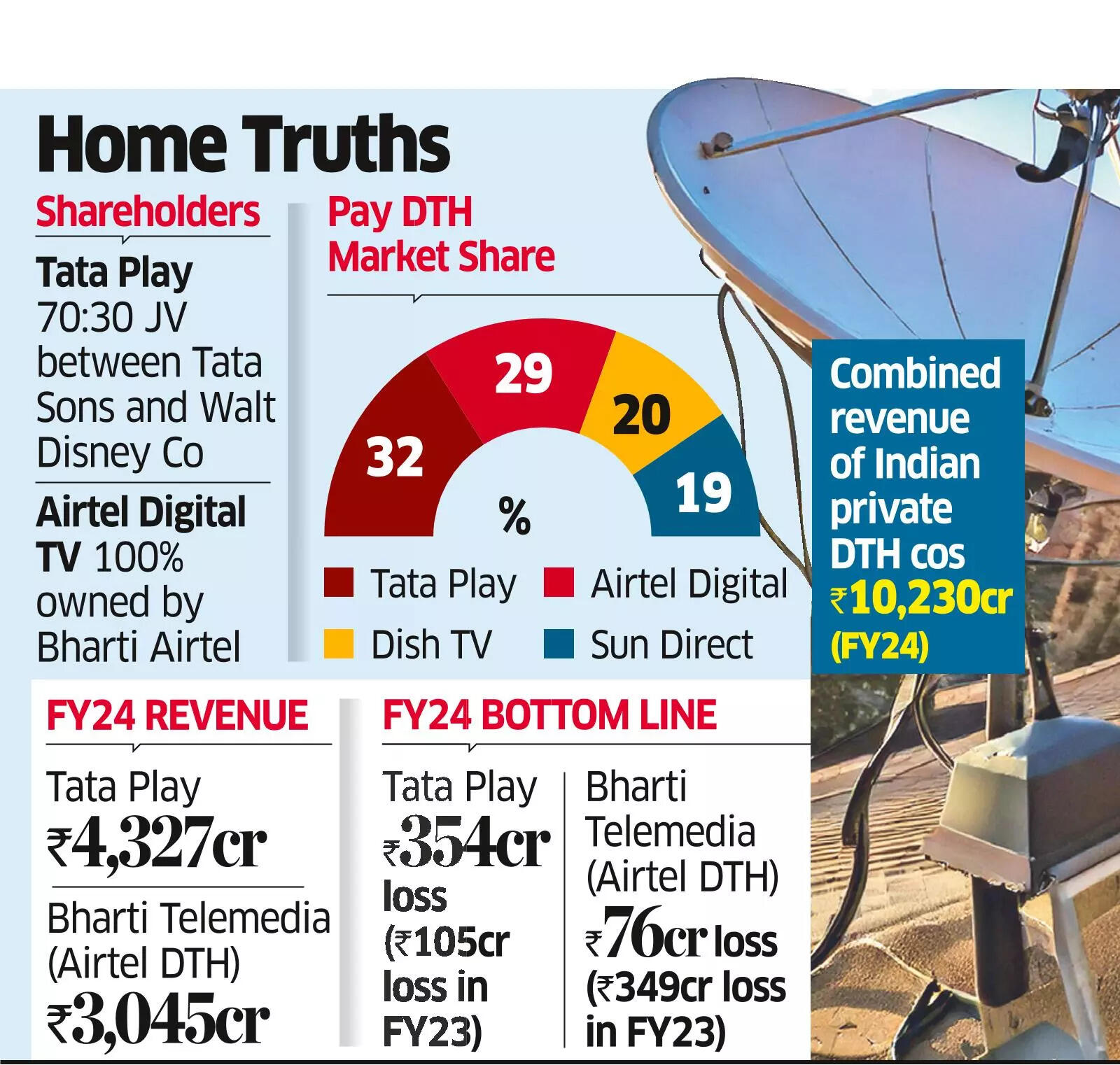

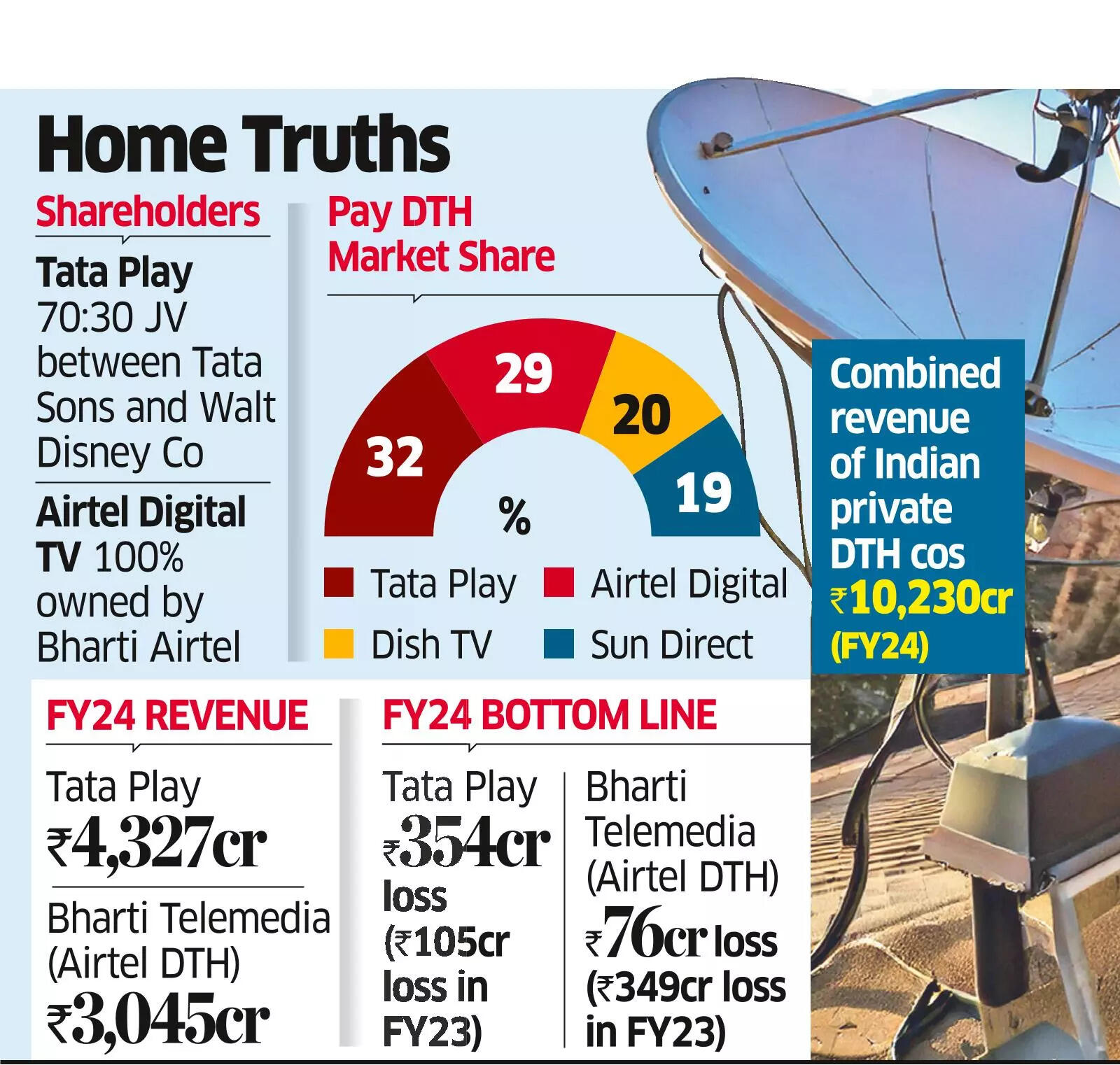

Bharti Telemedia, which runs the DTH business under Airtel Digital TV is the country’s second-largest DTH operator after Tata Play with a market share of 28.45% according to the Telecom Regulatory Authority of India (Trai) for the year ended March 31. Tata Play has a 32.53% share for the period, while Dish TV has a 20.46% share and Sun Direct has an 18.57% market share, Trai data shows.

Acquiring a majority stake in Tata Play is expected to help Airtel push more of its digital services into urban households, something rival Reliance Jio has successfully done over the last few years as a telecom and digital services provider, G Chokkalingam, founder of Mumbai-based Equinomics Research, said.

“Most DTH operators, including Tata Play, Airtel and Dish TV, have increasingly expanded their scope of services to tackle migration of consumers to OTT platforms. For Airtel, the challenge is two-fold because the accent will shift to convergence as Reliance and Disney merge,” Chokkalingam said.

In April this year, Bharti Airtel’s MD and CEO Gopal Vittal said that Airtel DTH had added 388,000 customers, which was the highest net addition for the direct-to-home service in 12 quarters.

This also comes amid a broader decline of 7.6 million DTH subscribers over the last three years, experts said, as streaming majors such as JioCinema, Disney+ Hotstar, Netflix and Amazon Prime Video take consumers away from DTH in urban areas. In rural areas, DD Free Dish, the free DTH platform of Prasar Bharati, has seen a migration of low-end consumers, sector experts said.

DTH players including Airtel, Tata Play and Dish TV have looked to tackle this problem with a combination of smart digital services, OTT aggregation and Android set-top boxes.

Vittal had said in April that revenue growth in DTH was driven by both customer additions and an increase in average revenue per user by pushing more bundled offerings to subscribers. For FY24, Airtel Digital TV’s net loss narrowed to Rs 76 crore in FY24 from Rs 349 crore in FY23. FY24 revenue, meanwhile, touched Rs 3,045 crore from Rs 2,949 crore in FY23, its results showed.

Tackling Disney

While a potential majority acquisition of Tata Play from the Tatas gives Airtel more room to unleash its suite of digital services in premium households, experts say that the company may have to eventually pick up Disney’s 30% stake for full control of the business.

Mails sent to Airtel and Tatas elicited no response till the time of going to press. Text messages to Disney Star on the future of its stake in Tata Play elicited no response at the time of going to press.

Disney inherited the Tata Play stake after its 2019 merger with Rupert Murdoch’s 21st Century Fox. It has been looking to exit the media distribution business in India as it remains focused on the merger with Reliance, according to industry sources. Worldwide, Disney has been streamlining operations by cutting costs and keeping its attention on its OTT operations.

-

02-25-2025, 11:19 AM

#1022

Tata Play, Airtel Digital TV in merger talks as DTH industry struggles amid streaming boom

Both sides are expected to announce a heads of terms agreement in the coming days, following which due diligence will begin.

Mumbai: The Tata and Bharti groups are finalising a merger between their loss-making direct-to-home (DTH) businesses, Tata Play and Airtel Digital TV, respectively, said people with knowledge of the matter. This comes as Indian consumers are cutting the cord and migrating to digital platforms for video consumption and live streaming.

The merger will take place through a share swap and help bump up Airtel’s non-mobile revenues through convergence. Airtel will hold more than 50% in the combined entity, said the people cited. Tata Play, India’s largest DTH provider, was originally Tata Sky and began as a joint venture with Rupert Murdoch’s News Corp. The Walt Disney Co took over that stake when it acquired Murdoch’s 21st Century Fox in 2019.

Airtel will get access to Tata Play’s 19 million homes, supporting its ‘triple play’ strategy of bundling telecom, broadband and DTH services.

The deal will mark the second major transaction in the DTH sector in about a decade, following the Dish TV-Videocon d2h merger in 2016. It also coincides with Reliance Industries and Walt Disney merging Star India and Viacom18 to form JioStar, India’s largest media and entertainment company with revenue of Rs 26,000 crore in FY24.

ET was the first to report on a likely Airtel Digital TV-Tata Play transaction on October 8 last year.

Both sides are expected to announce a heads of terms agreement in the coming days, following which due diligence will begin. After the merger, Airtel is expected to hold 52-55% of the combined entity while Tata Play shareholders, including Walt Disney, will hold 45-48%. The company is expected to be run by Airtel’s senior management though Tata is understood to be seeking two board seats. Both operations are being valued “more or less equally” at around Rs 6,000-7,000 crore, said one of the people cited.

“This will be a non-binding agreement,” said an executive. “But with both sides engaged for months, they should move fast to close out all the outstanding issues. For Tata, this has been a drag, and like telecom, they are striking an alliance with a group they are comfortable with.”

Airtel Digital TV is housed in Bharti Telemedia Ltd, which in turn is a wholly owned arm of the listed flagship Bharti Airtel.

Tata Sons, the holding company of the diversified conglomerate, owns 70% of Tata Play, having bought out Singapore investment firm Temasek Holding Pte’s 10% stake in April 2024 for Rs 835 crore ($100 million), valuing the company at $1 billion, down a third from its $3 billion pre-pandemic valuation. With IPO plans dropped and losses mounting, valuations have dipped further, said industry executives.

Disney will continue to own shares in the combined entity as the other stakeholders are unlikely to buy them out for cash at this juncture, said the people mentioned above. The US media giant has been looking to exit the TV distribution business after pruning its portfolio and merging its media operations with Reliance Jio in India.

The two entities had a total 35 million paid subscribers as of September 2024, while FY24 revenue exceeded Rs 7,000 crore. Additionally, Tata Play also has half a million broadband customers through its subsidiary Tata Play Broadband.

Airtel, Tata Sons and Disney didn’t respond to queries.

Tata Play declined to comment.

Analysts said consolidation is inevitable, given the decline of the pay-TV industry due to competition from video streaming and DD Free Dish, the free DTH platform operated by public broadcaster Prasar Bharati. Bharti Airtel's eventual plan is to explore converting Tata Play's top 5 million DTH customers into broadband customers with higher average revenue per users (ARPUs), said analysts.

The pay-TV subscriber base has shrunk from 120 million to 84 million homes in recent years. The decision by major broadcasters to make their free Hindi general entertainment channels (GECs) available on DD Free Dish is expected to further erode the pay-TV market. However, JioStar’s move to place live sports behind a paywall on its streaming service could provide some relief to pay-TV platforms.

A September (TRAI) report said the pay DTH subscriber base fell to 62 million in FY24 from 70 million in FY21 and had further declined to 60 million as of September 2024.

“Even though the DTH and broader pay-TV industry are in decline, Airtel will still be the largest player in the pay-TV market, with the ability to offer multiple services by bundling telecom, broadband, and DTH," said a DTH sector expert.

DTH operators have expanded their offerings beyond aggregating linear TV channels to aggregating OTT platforms digitally in an effort to retain subscribers and enhance engagement. However, experts argue that telecom operators are best positioned to dominate the OTT aggregation space due to their scale and ability to bundle data with content.

“There are a lot of contingent liabilities in the sector, most of which are regulatory in nature. From adjusted gross revenues (AGR) dues to GST, it's bothersome, especially when you are in an exit mode,” said another industry veteran.

According to demand notices issued by the ministry of information and broadcasting (MIB) for FY23 and FY24, Bharti Telemedia has a potential liability of Rs 5,580 crore related to disputed licence fees. The company had made provisions of approximately Rs 3,426 crore as of March 31, 2024, but does not anticipate any immediate payout.

Similarly, Tata Play has received a consolidated licence fee demand of Rs 3,628 crore, including Rs 1,401.66 crore in interest, from the MIB.

-

03-19-2025, 10:40 AM

#1023

Tata Sons' move to boost stake in Tata Play gets CCI regulatory clearance

Tata Sons gains regulatory clearance to acquire an additional 10 per cent stake in Tata Play, raising their share to 70 per cent, while Walt Disney retains 30 per cent. Tata Play and Airtel Digital TV are nearing a merger, forming a $1.6 billion entity to adapt to the ongoing shift to digital streaming. Together, they hold over half of India's 60 million DTH subscribers.

Tata Sons' acquisition of an additional 10 per cent stake in Tata Play from an affiliate of Singaporean sovereign wealth fund Temasek Holdings has received regulatory clearance, the Competition Commission of India (CCI) said on Monday.

The deal to buy Baytree Investments (Mauritius) Pte's holding in the direct-to-home (DTH) and digital content distribution platform will raise Tata Sons' stake to 70%. Walt Disney owns the remaining 30 per cent of the joint venture.

Tata Play and Airtel Digital TV are close to merging their satellite TV businesses, creating a $1.6 billion entity, as they seek to navigate the ongoing shift of subscribers to digital streaming, as per media report.

Tata Play and Airtel Digital TV accounted for more than 35 million paid subscribers as of September last year, representing more than half of India's 60 million DTH subscriber base, according to a government report.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote